oklahoma franchise tax payment

We would like to show you a description here but the site wont allow us. An incentive that rewards companies for.

Oklahoma Taxpayer Access Point Make an Online Payment 1 MAKE AN ONLINE PAYMENT Make an EFT credit card or debit card payment online.

. Corporations are taxed 125 for each 1000 of capital invested or otherwise used in Oklahoma up to a maximum levy of 20000 foreign corporations are assessed an additional 100 per year. Oklahoma requires all corporations that do business in the state to pay a franchise tax. Oklahoma levies a franchise tax on all corporations or associations doing business in the state.

FISCAL YEAR AND SHORT PERIOD RETURNS. A ten percent 10 penalty and one and one-fourth percent 125 interest. Complete the required fields on the Online Payment form.

The remittance of estimated franchise tax must be made on a tentative estimated franchise tax return Form 200. Any taxpayer with an Oklahoma franchise tax liability due and payable on or before July 1 2021 will be granted a waiver of any penalties andor interest for returns filed by August 1 2021 provided payment is received by September 15 2021. If filing a stand-alone OklahomaAnnual Franchise Tax Return Form 200 do not use this form to remit franchise tax.

Department of the Treasury. Oklahoma franchise tax is due and payable each year on July 1. Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales Tax Forms Publications Forms - Business Taxes Forms - Income Tax Publications Exemption Letters All Taxes Income - Individual Income - Businesses.

Corporations reporting zero franchise tax liability must still file an annual return. Cookies are required to use this site. The maximum annual franchise tax is 2000000.

Up to 25 cash back However Oklahoma S corporations have been required to pay the franchise tax and through the end of 2012 are required to pay the business activity tax. Many industries particularly in aerospace and defense which are part of Oklahomas economic engine pay higher than average wages and employ a high percentage of veterans. For corporations that owe the maximum amount of franchise tax 20000 their payment is due on May 1st of each year.

When is franchise tax due. Copyright 2007 Oklahoma Tax Commission Security Statement Privacy Statement Feedback OKgov Last Modified 10222007. Returns should be mailed to the Oklahoma Tax Commission PO Box 26800 Oklahoma City OK 73126-0800.

In Oklahoma the maximum amount of franchise tax a corporation can pay is 20000. And interest for late payments of franchise tax 100 of the franchise tax liability must be paid with the extension. While all corporations must file a report with the Secretary of State those with.

Once you have access to your Cigarette Wholesale account on OkTAP you can order stamps. Mail Form 504-C Application for Extension of Time to File an Oklahoma Income Tax Return for Corporations Partner-ships and Fiduciaries with. A description of the payment type will.

And you ARE ENCLOSING A PAYMENT then use this address. The rate is 125 for each 1000 of capital you invest or use in Oklahoma. For a corporation that has elected to change its filing period to match its fiscal year the franchise tax is due on the 15th day of the third month following the close of the corporations tax year.

In addition an individual S corporation shareholder will owe tax on his or her share of the corporations income. Time for Filing and Payment Information Oklahoma Franchise Tax is due and payable July 1st of each year unless a Franchise Election Form Form 200-F has been filed. The franchise tax applies solely to corporations with capital of 201000 or more.

2020 Tax Payment Deadline Extension. Click the Order Cigarette Stamps link on the sidebar and complete the order form. The report and tax will be delinquent if not paid on or before September 15.

Begin by clicking the Make an Online Payment link on the OKTAP home page. Click the Pay Now button to pay for the stamp order. Limited Liability Companies LLCs Like S corporations standard LLCs.

Click the continue arrow at the bottom of the screen to navigate to the payment window. Eligible entities are required to annually remit the franchise tax. Your browser appears to have cookies disabled.

Corporations that remitted the maximum amount of franchise tax for the preceding tax year do not qualify to file a combined income and franchise tax return. Indicate this amount on line 13 of the Form 512 page 6. Kansas City MO 64999-0002.

/cloudfront-us-east-1.images.arcpublishing.com/gray/NQ426LN2U5GDJAAD6DERFL76HY.jpg)

Bill To Erase State Income Tax Passes Committee In Oklahoma

Godzilla Monster S Inc By Roflo Felorez Deviantart Com On Deviantart Godzilla Godzilla Funny Godzilla Comics

Thinkbag Designed And Printed A 16 Pages Company Profile Brochure For Taxi Luxury Communications Strategy Luxury Branding Advertising Campaign

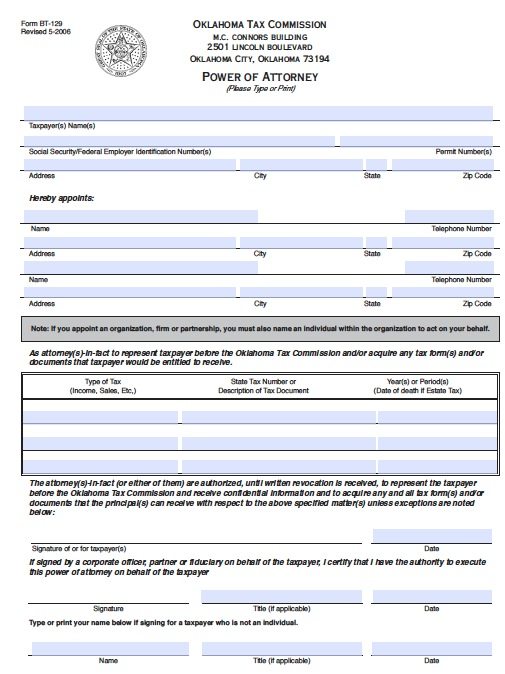

Free Tax Power Of Attorney Oklahoma Form Bt 129 Adobe Pdf

Californiataxtable Income Tax Brackets Tax Brackets Tax Prep

Where S My Refund Oklahoma H R Block

Oklahoma Plumbing License How To Become A Plumber In Oklahoma

Oklahoma Taxpayer Access Point

Oklahoma Tax Commission Oktaxcommission Twitter

/cloudfront-us-east-1.images.arcpublishing.com/gray/NQ426LN2U5GDJAAD6DERFL76HY.jpg)

Bill To Erase State Income Tax Passes Committee In Oklahoma

Oklahoma Taxpayer Access Point

Oklahoma Tax Reform Options Guide Tax Foundation

Pin By Catherine Bruhn On Animal Crossing Fun Animal Crossing Qr Animal Crossing Lol

Incorporate In Oklahoma Do Business The Right Way

Oklahoma State Tax Information Support

Trifold Brochure For Two Men And A Truck Trifold Brochure Moving Company Brochure