geothermal tax credit extension

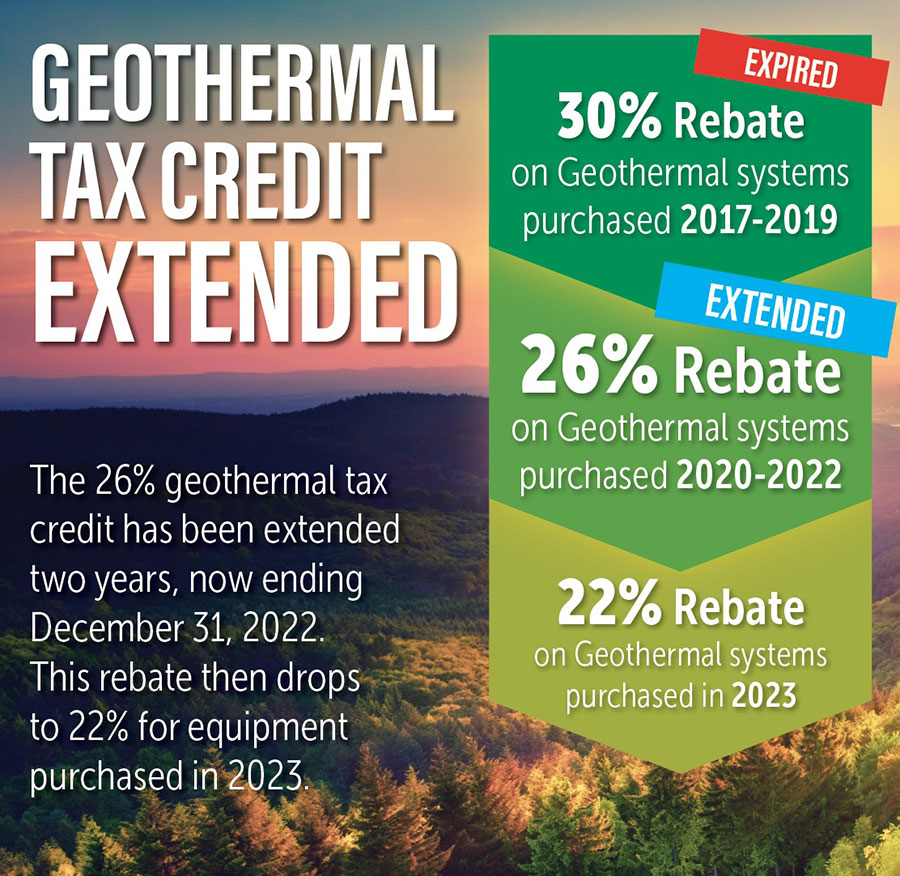

Lets say you purchase a geothermal system for. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009.

Duke Energy Residental Energy Efficiency Rebate Program Energize Ohio

This Tax credit was available through the end of 2016.

. The geothermal tax credit was extended to 2023 so act now for the most savings on your new geothermal unit. Keep all receipts from the purchase. In July a bill was introduced to the House and Senate to push for a five-year extension of the 30 tax credit for Geothermal systems.

1 2023 Federal Geothermal Tax. A 26 federal tax credit for residential ground source heat pump installations has been extended through December 31 2022. Try it for Free Now.

This Tax credit was available through the end of 2016. From now through December 31 2022 a federal tax credit for residential. The 26 federal tax credit was extended through 2022 and will drop to 22 in 2023 before expiring altogether so act now for.

The extension keeps the wind energy PTC in effect through 2012 while keeping the PTC alive for municipal solid waste qualified hydropower and biomass and geothermal energy. The new legislation lengthens the deadline for the credits for GHP installations. In December 2020 the tax credit for geothermal heat.

In 2019 the tax credit was renewed. Federal Geothermal Tax Credits have recently been amended thus you may have 26 Federal Geothermal Tax Credits to get for systems installed by Jan. A 26 federal tax credit for residential ground.

Christmas came early for the geothermal industry when the latest federal stimulus bill included a long-sought extension of. House of Representatives Ways and. Provided your heat pump meets these minimum specifications the process of applying for a geothermal tax credit is simple.

APPLYING FOR TAX CREDITS. Northern Virginia Tue - July 12th 2016 7pm - 9pm Location. As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the US.

As lawmakers hotly debate budget cuts and tax reform in Washington DC the Geothermal Exchange Organization GEO has formally asked the US. Extension for commercial and residential geothermal heat pump GHP tax credits. The incentive will be lowered to 22 for systems that are installed.

Ad Download or Email IRS 4868 More Fillable Forms Register and Subscribe Now. Geothermal Tax Incentives Extended. The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits.

The credits have been extended through 2023. A similar extension at the end of last year. The tax credit rate dipped to 40 of the full rate for 2019 projects compared to 60 for 2018 and 2020 and now 2021 projects.

For years the US government has incentivized geothermal heat pump installations with a Federal tax. Federal Tax Credit The recently signed Federal Budget and Stimulus bill includes an extension of the Federal geothermal heat pump GHP tax credits through 2023. Virginia 2017 Legislative Action by VGSHPA for Geothermal Tax Credit Grant Bill.

After expiring in 2016 the federal geothermal tax credit was reinstated in 2018 this time including commercial geothermal heat pumps as eligible energy systems. This would mean a 30 tax credit through 2024 a 26 tax. Use e-Signature Secure Your Files.

The Geothermal Tax Credit can offset regular income taxes and even alternative minimum taxes. Upload Modify or Create Forms. The energy tax credit can be combined with solar and wind credits as well as energy efficiency upgrade credits.

US Tax Credits Through 2023. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009.

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

Help Extend The Geothermal 30 Tax Credit Through 2024 Ecs Geothermal Inc

Geothermal Investment Tax Credit Extended Through 2023

Help Extend The Geothermal 30 Tax Credit Through 2024 Ecs Geothermal Inc

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

The Alliance For Green Heat Federal Tax Incentives For Wood And Pellet Stoves Sustainable Local And Affordable Heating

How The 2022 Federal Geothermal Tax Credit Works

Geothermal Tax Credits Extended Smart Choices

Geothermal Investment Tax Credit Extended Through 2023

Geothermal Heat Pump Tax Credits Approved By Congress Geothermal Heating And Cooling Chesapeake Geosystems

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

Geothermal Investment Tax Credit Extended Through 2023

Federal Tax Credits Geothermal Heat Pumps Energy Star

Tax Credits And Other Incentives For Geothermal Systems Waterfurnace

Understanding The Geothermal Tax Credit Extension

Geothermal Rebates Extended Corken Steel Products

What Is The 2021 Geothermal Tax Credit Climatemaster Geothermal Hvac

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac